7+ billion

Assets under management

At Gatestone Financial Partners, you and your best interests are at the center of everything we do. We built our team with purpose to combine diverse talents and capabilities, all with the commitment toward helping Gatestone clients pursue their most important goals. For more than 20 years, we have advised our clients through every type of investment environment, however challenging.

Advice across generations

Just as our clients and their families have multigenerational needs and goals, our team is multigenerational. With Gatestone, you and your family can be a client for life. Our comprehensive financial planning approach, decades of experience and access to global resources allow us to guide clients confidently along their unique paths forward.

As a team within the exclusive Private Wealth Management division at UBS, we connect you to the dynamic presence of one of the world‘s leading wealth managers. Private Wealth Advisors serve many of the firm‘s largest relationships, providing extensive reach and the distinct advantage of the firm‘s global perspective, insights and resources.

Align your life, goals and long-term strategy

Our planning process gives us a comprehensive and cohesive view of what you have and what you may need to pursue your goals. We believe that financial security and trust matter most to our clients. With a custom plan in place, you can be confident that we are focused on overseeing your integrated strategy so you can focus on other important personal and professional priorities.

Liquidity. Longevity. Legacy.

Our process begins with questions and discussions that help us focus on what’s really important to you. Then, we can help you organize your financial life into three key strategies: Liquidity—to help provide cash flow for short-term expenses, Longevity—for longer-term needs and Legacy—for needs that go beyond your own.

Liquidity: 0 – 3 years

Longevity: 4 years – lifetime

Legacy: Now – beyond your lifetime

Portfolio Management Program

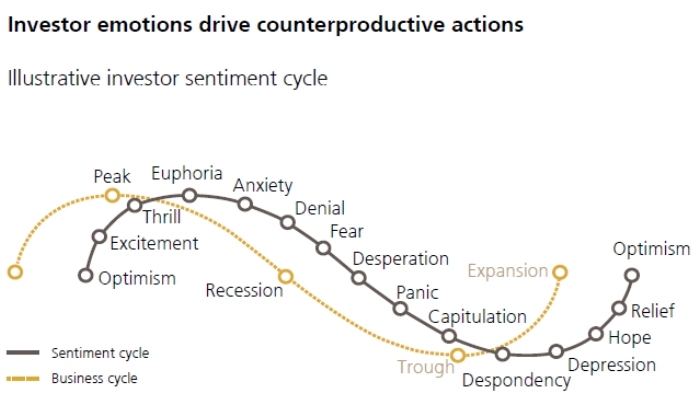

With decades navigating the markets and extensive background covering institutional equity and fixed income investors, we offer timely and actionable insight to our clients. We view market opportunities, asset allocation and risk through this institutional investor lens.

The depth of our understanding and disciplined process enable us to manage portfolios during the most volatile periods. Guided by our experience, our investment approach is prudent and focused on managing risk. As seasoned portfolio managers within the UBS Portfolio Management Program, we personally create your customized portfolio on a discretionary basis. As markets constantly change, our daily monitoring and oversight help ensure we’ll make appropriate adjustments when needed.

Illustration source: Gerstein Fisher Research

The Portfolio Management Program (PMP) is a wrap-fee advisory program in which our Financial Advisors manage client accounts on a discretionary basis. PMP is designed for clients who: (i) want to delegate portfolio management discretion to their Financial Advisor; (ii) are looking to implement a medium- to long-term investment plan; and (iii) prefer the consistency of fee-based pricing.

PMP is not appropriate for clients who: (i) want to maintain trading control over their account; (ii) seek a short-term investment; (iii) want to maintain consistently high levels of cash or money market funds, or invest primarily in no-load mutual funds; (iv) want to maintain highly concentrated positions that will not be sold regardless of market conditions; or (v) who anticipate significant withdrawals from the account.

Solutions for companies, employees and the executives who manage them

Beyond the relationships we have with individuals and families, our team is also experienced in providing corporate services to businesses, their employees and executive team.

For company benefits plans, streamlined administration is key. We can work with you and your employees to keep up with changing regulations, stay on top of requirements and ensure your equity awards are attracting and retaining top talent. With complicated equity award packages—as well as potentially complex tax consequences—executives need specific advice. As members of the UBS Equity Plan Advisory Services business, we help manage the complexities of equity compensation plan administration as well.

One firm. A world of opportunity.

As a UBS Private Wealth team, we have access to specialists and resources across all of UBS—locally and globally. From capital markets research, investment and private planning to highly bespoke solutions for family offices, we’re focused on providing you with clarity and intelligent perspective to make well-informed decisions about your business, your family and your future.

Advanced planning. Given the complexity of their wealth, our clients require thoughtfully customized approaches to addressing their objectives. Together with our Advanced Planning specialists, we’ll evaluate your unique needs, from the basics of creating a will to the tax, liquidity and wealth transfer considerations that factor into your long-term planning strategy. We can work with your legal and tax advisors to help ensure our advice is aligned.

Strategic philanthropy. For our clients seeking to give back, we can work with a dedicated team of philanthropy experts to address your current charitable goals and design a strategy for creating real impact in the world. We also engage other family members to provide education on philanthropy and participation strategies for the next generation. Should you need to offset tax liabilities from large liquidity events, we can recommend tax-efficient solutions such as private foundations and donor-advised funds.

The UBS Boutique Investment Banking Network. This select group of experienced investment banks focuses primarily on middle-market M&A and capital-raising services for family-owned and entrepreneur-led businesses.

Industry-leading wealth management research. By drawing upon our investment analysis and the global body of thought leadership and market insight of our Chief Investment Office (CIO), we help ensure our clients are receiving the firm’s best strategic and tactical allocation guidance.

Family Office Solutions Group. Because we understand the dynamics of families and their wealth transfer concerns, we can help you build a thoughtful wealth transition plan for future generations. Through our collaboration with the Family Office Solutions Group and more than 20 subject matter experts, we bring you the best of UBS insight and expertise to help you explore unique opportunities available to ultra high net worth families just like yours. We believe there’s no better platform for us to curate advice specifically for your complex needs across generations, including:

Daniel Kilmurray and Craig Dunton are among a select group of Private Wealth Advisors who have earned the UBS business designation of Family Office Consultant (FOC). They have undergone rigorous training to strengthen their knowledge and proficiency to help manage the investment, business, passion and legacy needs of sophisticated, ultra high net worth (UHNW) clients and their families. As Private Wealth Advisors and FOCs, they understand the complexities of intergenerational wealth and the challenges facing their clients. Working together, they align their specific needs to the full suite of UBS capabilities and help them pursue their most important goals.

Dan serves as the chief investment officer for Gatestone Financial Partners. He began his financial services career at Merrill Lynch in 1981 and transitioned to a research associate role at Laidlaw Adams and Peck in 1983, covering the entertainment, toy and game industries. In 1984, he became a financial advisor and hedge fund sales specialist for Kidder, Peabody & Co., which was acquired by UBS in 2000.

Dan's more than 30 years of financial service experience, knowledge, and leadership have led to his consistently being ranked as one of UBS top advisors in equity portfolio management and has been the team's CIO for 25 years. Dan helped found the Institutional Equities Group at UBS, the first joint venture between the UBS Investment Bank and Wealth Management in 2003 to cover hedge funds and high net worth individuals. Dan earned his B.A. from Lafayette College. He served on the Committee on Investments for the Lafayette College Board of Trustees, is an active donor and former board member of the National Council for Adoption. Dan founded and served as the President of the Wilmington Fund VT, created to rebuild Wilmington after the destruction from Hurricane Irene.

Craig joined UBS Private Bank in 1999 working in New York, Zurich, and London. In 2001, he moved to the U.S. Wealth Management business and partnered with Dan Kilmurray to grow their advisory practice. Bringing a global perspective, Craig focuses on financial planning and wealth management, specializing in developing strategies to meet the needs of high net worth individuals. He is responsible for the implementation and review of capital allocation across our advisory business.

Craig is a member of the Financial Planning Association and has been a speaker on the topics of planning and investments at New York Chapter events. He is an adjunct faculty member at New York University. In 2013, Craig was named to REP.'s inaugural “Top 40 Wirehouse Advisors Under 40.” He holds a B.S. from Cornell University and a graduate certificate in financial planning from New York University. Craig founded and ran a mentoring program between Cornell University alumni and New York City public high school students and is an active supporter of NYC hunger-ending initiatives.

With more than 40 years in the financial services industry, Bill prides himself on finding out all he can about his clients, so he can create a full picture of their financial and life goals. By understanding his clients’ unique needs, he provides holistic wealth management that sets the course for achieving long-term success. Rooted in his deep knowledge of fixed income securities, Bill began his career in 1980 with Lebenthal and Co. Over the next 15 years, he transitioned to Salomon Brothers, Bear Stearns and First Boston. In 1995, Bill joined UBS predecessor firm PaineWebber. Throughout his career, he has been dedicated to protecting the financial well-being of his clients—primarily ultra-high net worth individuals and families—by focusing on providing comprehensive financial planning and investment management.

Having built his practice on a disciplined and well-defined wealth management process, Bill offers guidance that is based on in-depth conversations with his clients and a thorough understanding of their goals, challenges and comfort with risk.

Bill earned his degree in economics from Trinity College in Hartford, CT. He has earned Series 3, 5, 7, 15, 63 and 65 securities licenses, as well as annuity and life insurance licenses. He and his wife of over 35 years have three grown children.

As one of the top Financial Advisors in the Workplace Wealth Services (WWS) group at UBS, Anthony Rundella has significant experience in assisting corporate executives. He provides guidance on corporate equity plans, as well as specializing in 10b5-1 plans, 10b-18 corporate stock buybacks and Rule 144 sales. Anthony has direct responsibility for numerous Fortune 100 and Fortune 500 company plans. These corporate relationships come from a variety of different sectors including financials, media, retail, defense, healthcare and consumer goods.

Anthony is an inaugural member of the UBS Corporate Advisory Board and the UBS Workplace Wealth Services Steering Committee which helps guide the strategic road map for the equity compensation business. Anthony has participated in numerous panels for various aspects of equity compensation, including corporate partnerships and pre-IPO education. He is a graduate of St. John's University.

Anthony is an active supporter of The Sunshine Kids, a non-profit organization dedicated to children with cancer and No Greater Sacrifice (NGS), providing scholarships and resources to the children of our nation's fallen and wounded Service members.

Andy began his career with UBS in the summer of 2011 as a member of the Graduate Training Program. He joined Gatestone Financial Partners in 2014 and specializes in customizing financial plans for individuals and their families. Andy spends the majority of his time working with clients to develop detailed strategies as it relates to all aspects of portfolio construction and broader estate planning. His focus is on helping families develop and execute investment, insurance, retirement, tax and estate planning. Andy has a particular emphasis on the complicated dynamics associated with the multi-generational transfer of wealth. He recognizes the importance of human behavior in investment decisions and has compiled research over the years to reassure and inform clients during all market cycles.

He is a CERTIFIED FINANCIAL PLANNER®™ as well as an Athletes & Entertainers Consultant and has been named a Forbes Top Next-Gen Wealth Advisor. Andy received a B.A. from Yale University.

John has been with UBS since 2006, providing comprehensive wealth management services tailored to the unique needs of high-net-worth families, corporate executives, and entrepreneurs. Specializing in financial planning and asset allocation, John helps clients develop strategies to achieve their long-term goals while managing risk effectively.

As a Corporate Stock Benefit Consultant, he assists clients in navigating the complexities of concentrated stock positions and equity awards, including stock options, restricted stock, and 10b5-1 plans. With a deep understanding of corporate benefits and retirement planning, John delivers personalized solutions to help clients build and protect their wealth. He holds a Bachelor of Science degree from Fairleigh Dickinson University.

Will serves his clients through all financial stages of life. He works with clients and their other professionals to develop, coordinate, and implement comprehensive strategies related to investment, insurance, retirement, tax, and estate planning. Will’s interest in investing and capital markets led him to the financial services industry, but his passion to help others in what matters most to them drove him to wealth management.

Prior to joining Gatestone Financial Partners, Will worked on the UBS Fixed Income Sales & Trading desk. Will was a lead salesperson working with individuals, family offices, and middle market clients. He then worked as a senior credit research analyst on the capital markets desk to help manage fixed income portfolios. Will graduated from Connecticut College where he earned a B.A. in economics with a minor in history and was a 4-year member of the varsity ice hockey program. He is a CFA® Charterholder and a CERTIFIED FINANCIAL PLANNER™ professional.

Joe is the head trader for our team. He spent a year at the investment banking firm, Hornblower & Weeks before joining the Financial Advisory Training program at UBS in 2000. From 2002 to 2005 Joe specialized in Sales & Trading for foreign banks and various hedge funds. He later joined Gatestone Financial Partners to support the trading of the team’s proprietary Equity Portfolios and managed execution for equity, debt, derivatives, foreign exchange and commodities. Currently, Joe oversees all transaction activities for our team. He received a B.S. from Arizona State University and he became a Certified Financial Planner® professional in 2023.

Prior to joining UBS in 2010, Jonathan worked at Merrill Lynch in the Private Banking and Investment Group.

Jon has more than 35 year of experience in the financial services industry, with extensive experience advising affluent individuals and multi-generational family groups.

Throughout his career, Jon has been responsible for assisting multiple clients with a variety of capital market transactions that have raised hundreds of millions of dollars in equity and debt. Among his other responsibilities, Jon is a key relationship manager for financial sponsors and hedge fund clients. He is an investment banking liaison with significant expertise and contacts in real estate, gaming and lodging verticals. Jonathan graduated from Ithaca College a B.S. degree in Finance.

I attended John Jay High School in Cross River, New York and continued on to receive my bachelors degree in Business Management from Moravian College.

I am FINRA-registered and hold Series 7 and 66 securities licenses. I joined UBS in January 2015 with a focus on financial planning and client relations.

My interests include golf, skiing, traveling, and being involved in my local community.

Griffin joined Gatestone Financial Partners as an Associate in the fall of 2024 and became a Financial Advisor in early 2025. He works with clients to provide comprehensive guidance for their current and long-term financial needs. He also works as a Corporate Stock Benefit Consultant helping clients navigate concentrated positions in company stock. Prior to joining UBS, he played four years of professional baseball for the Baltimore Orioles organization.

Griffin attended The College of Charleston and received a Bachelor of Science in Finance. He holds the Series 7 and 66 licenses.

Gwen is the team business manager for Gatestone Financial Partners. Prior to this role, she was team administrator specializing in Corporate Stock Benefit plans. She joined UBS in 2000 after working for Prudential. Gwen is responsible for taking care of our teams’ day-to-day service needs and overseeing administrative and processing functions. Gwen holds a B.A. from the University of Maryland.

Maureen began her career in financial services in 1991 with Smith Barney and joined UBS predecessor firm, PaineWebber, in 1994.

Working primarily with affluent individuals and families, Maureen is dedicated to helping clients build more than a financial plan, but also a life plan focused on their individual goals and needs. Beyond investment management, Maureen understands that clients want superior service and holistic wealth management that is centered on their individual financial situation.

Keyrn brings over two decades of invaluable experience to the financial services industry. His journey began in 1999 at TD Waterhouse, where he started as an account officer while completing his senior year of college at night. After three years there, he moved to Merrill Lynch, where he worked in roles spanning Wealth Management and the Research Department, over an eight year period. In 2010, Keyrn joined UBS, where he currently works as a trader for the team. In this role he collaborates closely with the head trader, overseeing the management of the team’s proprietary equity portfolios and executing transactions in equity, debt, derivatives and foreign exchange markets.

Keyrn graduated with a B.A. in Psychology from Hunter College and is a Certified Financial Planner™ professional. He holds the Series 7,9,10,31,63 and 65 securities licenses as well as the Life and Health insurance licenses.

Cynthia is the Client Service Associate for our wealth management business. She joined UBS in 2012 as a branch service associate, working in the Operations Department. She transitioned from branch operations to a client facing role in April of 2015. She is responsible for taking care of clients' day-to-day service needs and oversees client on-boarding, administrative, and processing functions. Cynthia received her B.B.A. degree from Pace University.

With 25 years of experience in the Financial Services Industry, Nancy is committed to providing superior client service experiences to all clients and places equal importance on all client issues or concerns and sees them through to completion. Those responsibilities include client onboarding, administrative and processing functions.

Nancy came to UBS in 2009 from Morgan Stanley, and prior to that she was with Wachovia Securities and Smith Barney, where she began her career in financial services. Nancy received her B.A. in Business from NYIT in Old Westbury, NY.

Nica is a Client Service Associate for our wealth management business. She started as an intern at UBS while in college and ultimately took a fulltime position in 2017. Nica is responsible for taking care of clients' day-to-day service needs and oversees client on-boarding, administrative, and processing functions. She received her B.A. degree from Hunter College in New York City.

Tom is the Client Service Associate for our wealth management business. He joined UBS in 2022 as a branch service associate, working in the Operations Department. He transitioned from branch operations to a client facing role in 2023. He is responsible for taking care of clients' day-to-day service needs and oversees client on-boarding, administrative, and processing functions. Tom graduated from Lehigh University with a B.S. in Finance

Edwin is the Corporate Service Associate for our corporate equity plan business. He joined UBS in 2008 as a branch service associate, working in the Operations Department. He transitioned from branch operations to a client facing role in 2023. Edwin is responsible for taking care of clients’ day-to-day service needs and oversees client on boarding, administrative and processing functions. Additionally, he is one of the specialists that works with our Corporate Stock Benefit plans.

Jennifer is a Senior Registered Client Service Associate for Gatestone Financial Partners. She is responsible for taking care of clients’ day-to-day service needs and oversees client on-boarding, administrative, and processing functions. Prior to this role she was a Registered Client Service Associate at Bank of America.

Jennifer graduated with a B.A. degree from the University of Georgia and is a CERTIFIED FINANCIAL PLANNER ™ professional.

Jimmy is a Registered Client Service Associate for our wealth management business. He joined UBS in 2025 into a client facing role handling the clients’ day-to-day service needs and overseeing the client on-boarding, administrative, and processing functions. Jimmy graduated from the University of South Carolina with a B.S. in Finance.

Dan serves as the chief investment officer for Gatestone Financial Partners. He began his financial services career at Merrill Lynch in 1981 and transitioned to a research associate role at Laidlaw Adams and Peck in 1983, covering the entertainment, toy and game industries. In 1984, he became a financial advisor and hedge fund sales specialist for Kidder, Peabody & Co., which was acquired by UBS in 2000.

Dan's more than 30 years of financial service experience, knowledge, and leadership have led to his consistently being ranked as one of UBS top advisors in equity portfolio management and has been the team's CIO for 25 years. Dan helped found the Institutional Equities Group at UBS, the first joint venture between the UBS Investment Bank and Wealth Management in 2003 to cover hedge funds and high net worth individuals. Dan earned his B.A. from Lafayette College. He served on the Committee on Investments for the Lafayette College Board of Trustees, is an active donor and former board member of the National Council for Adoption. Dan founded and served as the President of the Wilmington Fund VT, created to rebuild Wilmington after the destruction from Hurricane Irene.

Craig joined UBS Private Bank in 1999 working in New York, Zurich, and London. In 2001, he moved to the U.S. Wealth Management business and partnered with Dan Kilmurray to grow their advisory practice. Bringing a global perspective, Craig focuses on financial planning and wealth management, specializing in developing strategies to meet the needs of high net worth individuals. He is responsible for the implementation and review of capital allocation across our advisory business.

Craig is a member of the Financial Planning Association and has been a speaker on the topics of planning and investments at New York Chapter events. He is an adjunct faculty member at New York University. In 2013, Craig was named to REP.'s inaugural “Top 40 Wirehouse Advisors Under 40.” He holds a B.S. from Cornell University and a graduate certificate in financial planning from New York University. Craig founded and ran a mentoring program between Cornell University alumni and New York City public high school students and is an active supporter of NYC hunger-ending initiatives.

With more than 40 years in the financial services industry, Bill prides himself on finding out all he can about his clients, so he can create a full picture of their financial and life goals. By understanding his clients’ unique needs, he provides holistic wealth management that sets the course for achieving long-term success. Rooted in his deep knowledge of fixed income securities, Bill began his career in 1980 with Lebenthal and Co. Over the next 15 years, he transitioned to Salomon Brothers, Bear Stearns and First Boston. In 1995, Bill joined UBS predecessor firm PaineWebber. Throughout his career, he has been dedicated to protecting the financial well-being of his clients—primarily ultra-high net worth individuals and families—by focusing on providing comprehensive financial planning and investment management.

Having built his practice on a disciplined and well-defined wealth management process, Bill offers guidance that is based on in-depth conversations with his clients and a thorough understanding of their goals, challenges and comfort with risk.

Bill earned his degree in economics from Trinity College in Hartford, CT. He has earned Series 3, 5, 7, 15, 63 and 65 securities licenses, as well as annuity and life insurance licenses. He and his wife of over 35 years have three grown children.

As one of the top Financial Advisors in the Workplace Wealth Services (WWS) group at UBS, Anthony Rundella has significant experience in assisting corporate executives. He provides guidance on corporate equity plans, as well as specializing in 10b5-1 plans, 10b-18 corporate stock buybacks and Rule 144 sales. Anthony has direct responsibility for numerous Fortune 100 and Fortune 500 company plans. These corporate relationships come from a variety of different sectors including financials, media, retail, defense, healthcare and consumer goods.

Anthony is an inaugural member of the UBS Corporate Advisory Board and the UBS Workplace Wealth Services Steering Committee which helps guide the strategic road map for the equity compensation business. Anthony has participated in numerous panels for various aspects of equity compensation, including corporate partnerships and pre-IPO education. He is a graduate of St. John's University.

Anthony is an active supporter of The Sunshine Kids, a non-profit organization dedicated to children with cancer and No Greater Sacrifice (NGS), providing scholarships and resources to the children of our nation's fallen and wounded Service members.

Andy began his career with UBS in the summer of 2011 as a member of the Graduate Training Program. He joined Gatestone Financial Partners in 2014 and specializes in customizing financial plans for individuals and their families. Andy spends the majority of his time working with clients to develop detailed strategies as it relates to all aspects of portfolio construction and broader estate planning. His focus is on helping families develop and execute investment, insurance, retirement, tax and estate planning. Andy has a particular emphasis on the complicated dynamics associated with the multi-generational transfer of wealth. He recognizes the importance of human behavior in investment decisions and has compiled research over the years to reassure and inform clients during all market cycles.

He is a CERTIFIED FINANCIAL PLANNER®™ as well as an Athletes & Entertainers Consultant and has been named a Forbes Top Next-Gen Wealth Advisor. Andy received a B.A. from Yale University.

John has been with UBS since 2006, providing comprehensive wealth management services tailored to the unique needs of high-net-worth families, corporate executives, and entrepreneurs. Specializing in financial planning and asset allocation, John helps clients develop strategies to achieve their long-term goals while managing risk effectively.

As a Corporate Stock Benefit Consultant, he assists clients in navigating the complexities of concentrated stock positions and equity awards, including stock options, restricted stock, and 10b5-1 plans. With a deep understanding of corporate benefits and retirement planning, John delivers personalized solutions to help clients build and protect their wealth. He holds a Bachelor of Science degree from Fairleigh Dickinson University.

Will serves his clients through all financial stages of life. He works with clients and their other professionals to develop, coordinate, and implement comprehensive strategies related to investment, insurance, retirement, tax, and estate planning. Will’s interest in investing and capital markets led him to the financial services industry, but his passion to help others in what matters most to them drove him to wealth management.

Prior to joining Gatestone Financial Partners, Will worked on the UBS Fixed Income Sales & Trading desk. Will was a lead salesperson working with individuals, family offices, and middle market clients. He then worked as a senior credit research analyst on the capital markets desk to help manage fixed income portfolios. Will graduated from Connecticut College where he earned a B.A. in economics with a minor in history and was a 4-year member of the varsity ice hockey program. He is a CFA® Charterholder and a CERTIFIED FINANCIAL PLANNER™ professional.

Joe is the head trader for our team. He spent a year at the investment banking firm, Hornblower & Weeks before joining the Financial Advisory Training program at UBS in 2000. From 2002 to 2005 Joe specialized in Sales & Trading for foreign banks and various hedge funds. He later joined Gatestone Financial Partners to support the trading of the team’s proprietary Equity Portfolios and managed execution for equity, debt, derivatives, foreign exchange and commodities. Currently, Joe oversees all transaction activities for our team. He received a B.S. from Arizona State University and he became a Certified Financial Planner® professional in 2023.

Prior to joining UBS in 2010, Jonathan worked at Merrill Lynch in the Private Banking and Investment Group.

Jon has more than 35 year of experience in the financial services industry, with extensive experience advising affluent individuals and multi-generational family groups.

Throughout his career, Jon has been responsible for assisting multiple clients with a variety of capital market transactions that have raised hundreds of millions of dollars in equity and debt. Among his other responsibilities, Jon is a key relationship manager for financial sponsors and hedge fund clients. He is an investment banking liaison with significant expertise and contacts in real estate, gaming and lodging verticals. Jonathan graduated from Ithaca College a B.S. degree in Finance.

I attended John Jay High School in Cross River, New York and continued on to receive my bachelors degree in Business Management from Moravian College.

I am FINRA-registered and hold Series 7 and 66 securities licenses. I joined UBS in January 2015 with a focus on financial planning and client relations.

My interests include golf, skiing, traveling, and being involved in my local community.

Griffin joined Gatestone Financial Partners as an Associate in the fall of 2024 and became a Financial Advisor in early 2025. He works with clients to provide comprehensive guidance for their current and long-term financial needs. He also works as a Corporate Stock Benefit Consultant helping clients navigate concentrated positions in company stock. Prior to joining UBS, he played four years of professional baseball for the Baltimore Orioles organization.

Griffin attended The College of Charleston and received a Bachelor of Science in Finance. He holds the Series 7 and 66 licenses.

Gwen is the team business manager for Gatestone Financial Partners. Prior to this role, she was team administrator specializing in Corporate Stock Benefit plans. She joined UBS in 2000 after working for Prudential. Gwen is responsible for taking care of our teams’ day-to-day service needs and overseeing administrative and processing functions. Gwen holds a B.A. from the University of Maryland.

Maureen began her career in financial services in 1991 with Smith Barney and joined UBS predecessor firm, PaineWebber, in 1994.

Working primarily with affluent individuals and families, Maureen is dedicated to helping clients build more than a financial plan, but also a life plan focused on their individual goals and needs. Beyond investment management, Maureen understands that clients want superior service and holistic wealth management that is centered on their individual financial situation.

Keyrn brings over two decades of invaluable experience to the financial services industry. His journey began in 1999 at TD Waterhouse, where he started as an account officer while completing his senior year of college at night. After three years there, he moved to Merrill Lynch, where he worked in roles spanning Wealth Management and the Research Department, over an eight year period. In 2010, Keyrn joined UBS, where he currently works as a trader for the team. In this role he collaborates closely with the head trader, overseeing the management of the team’s proprietary equity portfolios and executing transactions in equity, debt, derivatives and foreign exchange markets.

Keyrn graduated with a B.A. in Psychology from Hunter College and is a Certified Financial Planner™ professional. He holds the Series 7,9,10,31,63 and 65 securities licenses as well as the Life and Health insurance licenses.

Cynthia is the Client Service Associate for our wealth management business. She joined UBS in 2012 as a branch service associate, working in the Operations Department. She transitioned from branch operations to a client facing role in April of 2015. She is responsible for taking care of clients' day-to-day service needs and oversees client on-boarding, administrative, and processing functions. Cynthia received her B.B.A. degree from Pace University.

With 25 years of experience in the Financial Services Industry, Nancy is committed to providing superior client service experiences to all clients and places equal importance on all client issues or concerns and sees them through to completion. Those responsibilities include client onboarding, administrative and processing functions.

Nancy came to UBS in 2009 from Morgan Stanley, and prior to that she was with Wachovia Securities and Smith Barney, where she began her career in financial services. Nancy received her B.A. in Business from NYIT in Old Westbury, NY.

Nica is a Client Service Associate for our wealth management business. She started as an intern at UBS while in college and ultimately took a fulltime position in 2017. Nica is responsible for taking care of clients' day-to-day service needs and oversees client on-boarding, administrative, and processing functions. She received her B.A. degree from Hunter College in New York City.

Tom is the Client Service Associate for our wealth management business. He joined UBS in 2022 as a branch service associate, working in the Operations Department. He transitioned from branch operations to a client facing role in 2023. He is responsible for taking care of clients' day-to-day service needs and oversees client on-boarding, administrative, and processing functions. Tom graduated from Lehigh University with a B.S. in Finance

Edwin is the Corporate Service Associate for our corporate equity plan business. He joined UBS in 2008 as a branch service associate, working in the Operations Department. He transitioned from branch operations to a client facing role in 2023. Edwin is responsible for taking care of clients’ day-to-day service needs and oversees client on boarding, administrative and processing functions. Additionally, he is one of the specialists that works with our Corporate Stock Benefit plans.

Jennifer is a Senior Registered Client Service Associate for Gatestone Financial Partners. She is responsible for taking care of clients’ day-to-day service needs and oversees client on-boarding, administrative, and processing functions. Prior to this role she was a Registered Client Service Associate at Bank of America.

Jennifer graduated with a B.A. degree from the University of Georgia and is a CERTIFIED FINANCIAL PLANNER ™ professional.

Jimmy is a Registered Client Service Associate for our wealth management business. He joined UBS in 2025 into a client facing role handling the clients’ day-to-day service needs and overseeing the client on-boarding, administrative, and processing functions. Jimmy graduated from the University of South Carolina with a B.S. in Finance.

Eligibility is based on quantitative factors and is not necessarily related to the quality of the investment advice. For more information on third party rating methodologies, please visit ubs.com/us/en/designation-disclosures.

Eligibility is based on quantitative factors and is not necessarily related to the quality of the investment advice. For more information on third party rating methodologies, please visit ubs.com/us/en/designation-disclosures.

7+ billion

Assets under management

22 person

seasoned team

150+

Collective years of experience

$6.9 trn

UBS Group invested assets

As of 10/29/2025

51 countries

Our global footprint

Global leader

UBS is a leading and truly global wealth manager

Geopolitics, trade and your portfolio

In times of heightened uncertainty, who you trust for financial guidance matters more than ever. For over160 years, UBS has helped clients through times of volatility with clarity and resiliency.

Get in touch with our team and we’ll help you turn today’s market uncertainty into informed confidence.

This website uses cookies to make sure you get the best experience on our website. You can find more information under the Privacy Statement. You are free to change your cookies' settings in the privacy settings.

Go to privacy settings