$6.9 trn

UBS Group invested assets

As of 10/29/2025

We make a real impact in the lives of our clients by guiding them through major life events and helping them preserve and pass on their wealth. Our customized approach focuses on thoughtful financial planning and wealth management that looks beyond your investments and encompasses all aspects of your financial life.

Forbes Best-in-State Wealth Management Teams, 2026

The Forbes rating is compiled by Shook Research and awarded annually in January, based on information from a 12 month period ending March of the prior year.

Eligibility is based on quantitative factors and is not necessarily related to the quality of the investment advice. For more information on third party rating methodologies, please visit ubs.com/us/en/designation-disclosures.

Our experience and structured planning process drives a comprehensive financial plan and customized investment strategies. Depending on where you are in your life and the priorities that matter most, our planning conversations may focus on liquidity management, your cash flow needs, asset replacement solutions such as insurance, estate planning strategies, or tax and legal structures such as trusts and philanthropic vehicles.

Talking about future financial responsibility can be an emotional and challenging topic for families. Whether you’re discussing an inheritance, insurance, a business transition or wealth transfer, an open, honest discussion among family members makes the process more rewarding for everyone. Let us show you how.

Financial decision-making is easier when you have the benefit of a trusted source of advice. Our team is here for you with planning-based solutions to help you confidently take charge of your financial world. It's about helping you feel empowered to make important decisions about today’s opportunities and challenges—and tomorrow's.

What’s really important to you—today and for the long term? UBS Wealth Way starts with questions and discussions that can help you organize your financial life into three key dimensions: Liquidity—to help provide cash flow for short-term expenses, Longevity—for longer-term needs and Legacy—for needs that go beyond your own.

UBS Wealth Way is an approach incorporating Liquidity. Longevity. Legacy. strategies that UBS Financial Services Inc. and our Financial Advisors can use to assist clients in exploring and pursuing their wealth management needs and goals over different time frames. This approach is not a promise or guarantee that wealth, or any financial results, can or will be achieved. All investments involve the risk of loss, including the risk of loss of the entire investment. Time frames may vary. Strategies are subject to individual client goals, objectives and suitability.

When it comes to planning for important goals, staying ahead of changing tax legislation can help you keep on track. Now is a good time of year to get on top of your planning, especially in light of upcoming potential tax law changes.

What are the causes you are passionate about? Whatever your objectives, we can help you explore new and innovative ways to make a positive impact on the world. Through our network and the UBS Family Advisory and Philanthropy Services, we’ll work with you and family members to help provide education on philanthropy, practical solutions and tax-efficient investment strategies for creating a meaningful and lasting legacy.

What you need to know now

Our bi-weekly newsletter gives you insights into what’s top of mind for investors:

Discussing and dividing wealth across generations

Even though high net worth investors have made strides over the last eight years with estate planning, they worry about the financial and familial discord that can accompany wealth transfer.

An overview of philanthropic strategies and their impact to help you evaluate different options.

Our mission is to provide quality strategies customized to your needs. Our goal is to be your primary source of financial advice. To this end, we concentrate our efforts on developing long-term relationships through a commitment to quality client service.

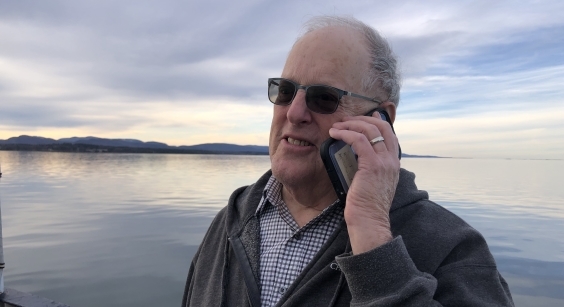

Growing up as a doctor’s son, Don watched his father’s compassion with patients. Now, he practices the same caring manner with his planning and wealth management clients. The result is a 30+ year career distinguished by his belief that the well-being of his clients comes first.

Don joined UBS in 2013, bringing broad financial planning knowledge and special insight into retirement and education planning, as well as portfolio management. At Smith Barney, Morgan Stanley and now UBS, Don focuses on each client’s goals and risk tolerance. With the strong belief that these two factors need to mesh just right for each client to have a successful investment experience, Don works hard to strike the right balance. Developing the relationships to help find this balance, and educating his clients along the way, is what Don most enjoys about working as a wealth manager.

Don graduated from Skidmore College with a B.S. in accounting, and he earned an M.B.A. from Fordham University. He has served in several lay-leadership roles with Jewish Federation of Greater Metrowest and the Healthcare Foundation of New Jersey. Don and his wife raised their family during the 30 years they spent living in Westfield, NJ. Now a full-time resident of Colorado, they love spending time in the mountains and are avid skiers and hikers. Volunteer time is now devoted to the Telluride Adaptive Sports Program as an on-snow instructor, bridging the experience he previously had as a PSIA certified instructor.

While Colorado may now be home, Much of Don’s family is back east. He is frequently back in the office with his team and to meet with clients. Gratitude for this flexibility, and the continued enjoyment of helping his clients achieve their goals is what will keep Don working full-time for many years to come.

Susan joined UBS in 2013 and brings over 27 years of financial services experience to the firm. Interested in finance from an early age, she developed her tax-free bond expertise at a small municipal bond firm where she worked for 16 years. Susan moved to Smith Barney for the opportunity to offer more products to her clients, as she has always professed the importance of diversification. She believes that UBS offers a wide product selection, yet also enables her to give personalized service in a boutique setting, an enviable combination for her clients.

A fixed income expert, Susan also has a keen eye for bonds with high interest and low risk. Susan treats clients like family and prefers to personally recommend and select products, yet she always consults team members with other specialties in order to find the best investments. Her retired clients especially benefit from her ability to find a better value than the average market offering.

Susan is a graduate of Ithaca College. She supports several charitable organizations, including GlassRoots in Newark, the United Jewish Federation and the Susan G. Komen Foundation. She lives in South Orange, New Jersey with her husband and two boys. In her free time, Susan is an avid golfer who also enjoys tennis, fitness and travel.

Since 1995, David has been providing comprehensive wealth management advice to his high net worth clients. David enjoys educating his clients about the wealth management process, helping them to organize their personal finances and define their goals. In 1995, David began to serve as a Financial Advisor with Smith Barney, bringing his trademark commitment to high-trust relationships to help his clients with their financial goals. He joined UBS in 2013.

In recognition for having met the highest standards for the practice of financial planning, David was designated a Certified Financial Planner™ by CFP® Board of Standards in 2001. His background includes financial planning, estate planning, insurance, taxation and retirement planning. David is dedicated to long-term relationships with his clients and continues to offer high-caliber professional service. David enjoys swimming, listening to music, good conversation and sharing quality time with his family.

Born into the business, Rachel learned to love finance from her father, a stockbroker for over 60 years. After spending school vacations in his office at E.F. Hutton, she felt right at home in her first job after college as a trainer at Kidder Peabody. There, her mentor transitioned her to the brokerage side, where keen market knowledge and relationship-building skills made her a natural fit. Rachel later became a Financial Advisor in 1994 for Smith Barney Shearson and was at Morgan Stanley for 19 years until joining UBS in 2013.

Rachel’s primary focus is client contact. Clients reward her responsiveness and expertise with the highest compliment: referring her to their children and grandchildren. Serving multi-generation families is a testament to Rachel’s meaningful relationships. Working with clients at all life stages developed her broad wealth management knowledge, with a special focus on education funding and retirement planning.

A graduate of George Washington University with a B.S. in political science, Rachel also holds life and health insurance licenses in order to assist clients with long-term-care planning. Rachel serves on the boards of the Greater Newark Conservancy, which promotes environmental stewardship in Newark, and the Jewish Women’s Foundation, an organization of philanthropists helping women and girls to realize their full potential. Rachel was recently recognized for her work with Greater Newark Conservancy as a national finalist for the Community Service Award as part of the 13th Annual Invest in Others Awards. She lives in Maplewood, NJ with her husband Marc and their two children.

Liz is a Senior Wealth Strategy Associate for The Short Hills Group. Liz is committed to helping clients define their financial goals and guiding them to solutions to achieve those goals. She also prioritizes addressing client inquires quickly and efficiently. As a CERTIFIED FINANCIAL PLANNER® professional, Liz has undergone rigorous training in various areas, including retirement planning, education planning, investment strategy, wealth transfer, tax optimization, and risk management.

She previously worked within the Wealth Advice Center for UBS for nearly 5 years. She built and deepened relationships with clients by providing them with exceptional wealth management services and solutions through gaining an understanding of clients’ situations and presenting all appropriate solutions while adhering to compliance and operational procedures to protect clients. Because of her dedication and commitment to clients she received the Ed Ruth award for exemplifying the client experience above all else.

Liz holds the CFP® certification, SIE, Series 7, Series 66, Series 9, and Series 10 FINRA registrations. Additionally she holds the NJ Insurance Producer for Life Insurance and Accident & Health Insurance.

Outside of UBS, Liz has performed at Carnegie Hall 25 times through winning first place at competitions such as American Fine Arts Festival, Piano Teachers Society of America, Russian Music Festival, and Intl. Crescendo. Liz has also competed on a national level from 2013-2020 for Fencing. Liz also actively supports local organizations such as Shave for a Cure and Cycle for Survival. She enjoys fitness, travel and spending time with family and friends.

Growing up as a doctor’s son, Don watched his father’s compassion with patients. Now, he practices the same caring manner with his planning and wealth management clients. The result is a 30+ year career distinguished by his belief that the well-being of his clients comes first.

Don joined UBS in 2013, bringing broad financial planning knowledge and special insight into retirement and education planning, as well as portfolio management. At Smith Barney, Morgan Stanley and now UBS, Don focuses on each client’s goals and risk tolerance. With the strong belief that these two factors need to mesh just right for each client to have a successful investment experience, Don works hard to strike the right balance. Developing the relationships to help find this balance, and educating his clients along the way, is what Don most enjoys about working as a wealth manager.

Don graduated from Skidmore College with a B.S. in accounting, and he earned an M.B.A. from Fordham University. He has served in several lay-leadership roles with Jewish Federation of Greater Metrowest and the Healthcare Foundation of New Jersey. Don and his wife raised their family during the 30 years they spent living in Westfield, NJ. Now a full-time resident of Colorado, they love spending time in the mountains and are avid skiers and hikers. Volunteer time is now devoted to the Telluride Adaptive Sports Program as an on-snow instructor, bridging the experience he previously had as a PSIA certified instructor.

While Colorado may now be home, Much of Don’s family is back east. He is frequently back in the office with his team and to meet with clients. Gratitude for this flexibility, and the continued enjoyment of helping his clients achieve their goals is what will keep Don working full-time for many years to come.

Susan joined UBS in 2013 and brings over 27 years of financial services experience to the firm. Interested in finance from an early age, she developed her tax-free bond expertise at a small municipal bond firm where she worked for 16 years. Susan moved to Smith Barney for the opportunity to offer more products to her clients, as she has always professed the importance of diversification. She believes that UBS offers a wide product selection, yet also enables her to give personalized service in a boutique setting, an enviable combination for her clients.

A fixed income expert, Susan also has a keen eye for bonds with high interest and low risk. Susan treats clients like family and prefers to personally recommend and select products, yet she always consults team members with other specialties in order to find the best investments. Her retired clients especially benefit from her ability to find a better value than the average market offering.

Susan is a graduate of Ithaca College. She supports several charitable organizations, including GlassRoots in Newark, the United Jewish Federation and the Susan G. Komen Foundation. She lives in South Orange, New Jersey with her husband and two boys. In her free time, Susan is an avid golfer who also enjoys tennis, fitness and travel.

Since 1995, David has been providing comprehensive wealth management advice to his high net worth clients. David enjoys educating his clients about the wealth management process, helping them to organize their personal finances and define their goals. In 1995, David began to serve as a Financial Advisor with Smith Barney, bringing his trademark commitment to high-trust relationships to help his clients with their financial goals. He joined UBS in 2013.

In recognition for having met the highest standards for the practice of financial planning, David was designated a Certified Financial Planner™ by CFP® Board of Standards in 2001. His background includes financial planning, estate planning, insurance, taxation and retirement planning. David is dedicated to long-term relationships with his clients and continues to offer high-caliber professional service. David enjoys swimming, listening to music, good conversation and sharing quality time with his family.

Born into the business, Rachel learned to love finance from her father, a stockbroker for over 60 years. After spending school vacations in his office at E.F. Hutton, she felt right at home in her first job after college as a trainer at Kidder Peabody. There, her mentor transitioned her to the brokerage side, where keen market knowledge and relationship-building skills made her a natural fit. Rachel later became a Financial Advisor in 1994 for Smith Barney Shearson and was at Morgan Stanley for 19 years until joining UBS in 2013.

Rachel’s primary focus is client contact. Clients reward her responsiveness and expertise with the highest compliment: referring her to their children and grandchildren. Serving multi-generation families is a testament to Rachel’s meaningful relationships. Working with clients at all life stages developed her broad wealth management knowledge, with a special focus on education funding and retirement planning.

A graduate of George Washington University with a B.S. in political science, Rachel also holds life and health insurance licenses in order to assist clients with long-term-care planning. Rachel serves on the boards of the Greater Newark Conservancy, which promotes environmental stewardship in Newark, and the Jewish Women’s Foundation, an organization of philanthropists helping women and girls to realize their full potential. Rachel was recently recognized for her work with Greater Newark Conservancy as a national finalist for the Community Service Award as part of the 13th Annual Invest in Others Awards. She lives in Maplewood, NJ with her husband Marc and their two children.

Liz is a Senior Wealth Strategy Associate for The Short Hills Group. Liz is committed to helping clients define their financial goals and guiding them to solutions to achieve those goals. She also prioritizes addressing client inquires quickly and efficiently. As a CERTIFIED FINANCIAL PLANNER® professional, Liz has undergone rigorous training in various areas, including retirement planning, education planning, investment strategy, wealth transfer, tax optimization, and risk management.

She previously worked within the Wealth Advice Center for UBS for nearly 5 years. She built and deepened relationships with clients by providing them with exceptional wealth management services and solutions through gaining an understanding of clients’ situations and presenting all appropriate solutions while adhering to compliance and operational procedures to protect clients. Because of her dedication and commitment to clients she received the Ed Ruth award for exemplifying the client experience above all else.

Liz holds the CFP® certification, SIE, Series 7, Series 66, Series 9, and Series 10 FINRA registrations. Additionally she holds the NJ Insurance Producer for Life Insurance and Accident & Health Insurance.

Outside of UBS, Liz has performed at Carnegie Hall 25 times through winning first place at competitions such as American Fine Arts Festival, Piano Teachers Society of America, Russian Music Festival, and Intl. Crescendo. Liz has also competed on a national level from 2013-2020 for Fencing. Liz also actively supports local organizations such as Shave for a Cure and Cycle for Survival. She enjoys fitness, travel and spending time with family and friends.

Eligibility is based on quantitative factors and is not necessarily related to the quality of the investment advice. For more information on third party rating methodologies, please visit ubs.com/us/en/designation-disclosures.

Eligibility is based on quantitative factors and is not necessarily related to the quality of the investment advice. For more information on third party rating methodologies, please visit ubs.com/us/en/designation-disclosures.

Jimmy entered the finance world as a paid intern while in college. He became a licensed broker in 1962. He has led the Short Hills Group as you have known us for more than a decade now. Jimmy has been a devoted, thoughtful and talented advisor to generations of families. He'll miss the relationships he's built through these decades but he's looking forward to his next chapter in retirement.

It's a good time to consider annuities

Annuities, which can help to generate secure and reliable income for life, are becoming increasingly popular among retirees.

$6.9 trn

UBS Group invested assets

As of 10/29/2025

51 countries

Our global footprint

Global leader

UBS is a leading and truly global wealth manager

This website uses cookies to make sure you get the best experience on our website. You can find more information under the Privacy Statement. You are free to change your cookies' settings in the privacy settings.

Go to privacy settings