$6.9 trn

UBS Group invested assets

As of 10/29/2025

Planning for your family’s entire financial needs

The strength of your business is reflected in the dedication of your employees. When it comes to administering your equity compensation plans, it's more important than ever to have the right advisor at your side. Whether we're advising a new professional or your most seasoned senior executive, we provide equity plan services, financial wellness solutions and personalized advice and education across your company.

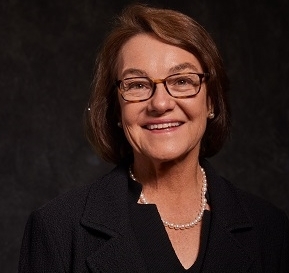

Emily W. Van Hoorickx is a highly distinguished professional in the equity compensation field. As a Certified Financial Planner (CFP™), Certified Equity Professional (CEP), Corporate Stock Benefit Consultant, and as one of the select few advisors with the designation of Wealth Advisor, she brings to the table both a unique perspective in helping her corporate clients plan and manage their equity compensation plans, as well as in helping individuals navigate the challenges and opportunities particular to company stock compensation plans.

Emily is a founding member of both the National Association of Stock Plan Professionals (NASPP) and the Global Equity Organization (GEO). She is a two-time past president of the Silicon Valley Chapter of NASPP and serves on the board of the Certified Equity Professional Institute (CEPI), having served as Chair twice. Emily’s education includes a degree from the University of California at Berkeley. She has studied in Turnhout, Belgium, and Oxford. Emily has been married for over 40 years and has brought her daughter Madeline into the practice.

With a robust background in financial planning centered around equity compensation, Madeline offers an all-encompassing wealth management service tailored for high-net-worth individuals significantly compensated in company stock. Her profound understanding of the unique challenges and opportunities that accompany these benefit plans empowers her clients to seamlessly traverse critical issues to attain their familial financial goals. Madeline's approach involves meticulous analysis of a client's personal financial circumstances, benefit plans, and the shifting economic landscape, enabling her to create fully bespoke financial strategies.

Madeline started at UBS through the highly competitive Intergenerational Advisory Program. During her tenure at UBS' headquarters in Weehawken, NJ, Madeline worked closely with the employees of UBS’ corporate clients, offering tailored advice and guidance regarding their plans. Her passion for delivering outstanding wealth management advice to employees of UBS' corporate clients led her back to the Bay Area to join Silicon Valley Investment Group in 2018.

Madeline holds a B.S. in Business Administration and a B.A. in Economics from the University of Redlands. Her time at the University was marked by both academic and athletic achievements, as she swam competitively and earned membership to the Omicron Delta Epsilon Honor Society for Economics. Additionally, she actively participated in the rotary club and contributed to managing the school’s investment fund. In her downtime, Madeline is an outdoor enthusiast, enjoying activities such as swimming, skiing, and hiking.

Robert delivers a comprehensive wealth management experience by focusing on detailed financial and estate planning, portfolio management and wealth transfer strategies. He works closely with UBS specialists, tax advisors and estate attorneys to help clients achieve their defined goals and objectives. Robert has been in wealth management since 2009 and joined UBS Financial Services in February 2013. Prior to UBS, Robert worked for Wells Fargo Advisors.

Raised in Sun Valley, Idaho, Robert moved to Los Angeles to pursue his passion for wealth management. He received his B.S. in Finance from California State University, Northridge. Robert currently lives in Pasadena with his family. He can be found spending his spare time volunteering, traveling and maintaining an overall active lifestyle by practicing Krav Maga, snowboarding, hiking and occasionally playing squash.

David Hurzeler is a registered client service associate serving as the backbone of SVIG. Prior to his current role, David was part of the Workplace Wealth Services Operations Team. David earned his B.S. Degree in Finance at Cal Poly Pomona. His hobbies include golfing and autocross.

Emily W. Van Hoorickx is a highly distinguished professional in the equity compensation field. As a Certified Financial Planner (CFP™), Certified Equity Professional (CEP), Corporate Stock Benefit Consultant, and as one of the select few advisors with the designation of Wealth Advisor, she brings to the table both a unique perspective in helping her corporate clients plan and manage their equity compensation plans, as well as in helping individuals navigate the challenges and opportunities particular to company stock compensation plans.

Emily is a founding member of both the National Association of Stock Plan Professionals (NASPP) and the Global Equity Organization (GEO). She is a two-time past president of the Silicon Valley Chapter of NASPP and serves on the board of the Certified Equity Professional Institute (CEPI), having served as Chair twice. Emily’s education includes a degree from the University of California at Berkeley. She has studied in Turnhout, Belgium, and Oxford. Emily has been married for over 40 years and has brought her daughter Madeline into the practice.

With a robust background in financial planning centered around equity compensation, Madeline offers an all-encompassing wealth management service tailored for high-net-worth individuals significantly compensated in company stock. Her profound understanding of the unique challenges and opportunities that accompany these benefit plans empowers her clients to seamlessly traverse critical issues to attain their familial financial goals. Madeline's approach involves meticulous analysis of a client's personal financial circumstances, benefit plans, and the shifting economic landscape, enabling her to create fully bespoke financial strategies.

Madeline started at UBS through the highly competitive Intergenerational Advisory Program. During her tenure at UBS' headquarters in Weehawken, NJ, Madeline worked closely with the employees of UBS’ corporate clients, offering tailored advice and guidance regarding their plans. Her passion for delivering outstanding wealth management advice to employees of UBS' corporate clients led her back to the Bay Area to join Silicon Valley Investment Group in 2018.

Madeline holds a B.S. in Business Administration and a B.A. in Economics from the University of Redlands. Her time at the University was marked by both academic and athletic achievements, as she swam competitively and earned membership to the Omicron Delta Epsilon Honor Society for Economics. Additionally, she actively participated in the rotary club and contributed to managing the school’s investment fund. In her downtime, Madeline is an outdoor enthusiast, enjoying activities such as swimming, skiing, and hiking.

Robert delivers a comprehensive wealth management experience by focusing on detailed financial and estate planning, portfolio management and wealth transfer strategies. He works closely with UBS specialists, tax advisors and estate attorneys to help clients achieve their defined goals and objectives. Robert has been in wealth management since 2009 and joined UBS Financial Services in February 2013. Prior to UBS, Robert worked for Wells Fargo Advisors.

Raised in Sun Valley, Idaho, Robert moved to Los Angeles to pursue his passion for wealth management. He received his B.S. in Finance from California State University, Northridge. Robert currently lives in Pasadena with his family. He can be found spending his spare time volunteering, traveling and maintaining an overall active lifestyle by practicing Krav Maga, snowboarding, hiking and occasionally playing squash.

David Hurzeler is a registered client service associate serving as the backbone of SVIG. Prior to his current role, David was part of the Workplace Wealth Services Operations Team. David earned his B.S. Degree in Finance at Cal Poly Pomona. His hobbies include golfing and autocross.

Eligibility is based on quantitative factors and is not necessarily related to the quality of the investment advice. For more information on third party rating methodologies, please visit ubs.com/us/en/designation-disclosures.

Eligibility is based on quantitative factors and is not necessarily related to the quality of the investment advice. For more information on third party rating methodologies, please visit ubs.com/us/en/designation-disclosures.

$6.9 trn

UBS Group invested assets

As of 10/29/2025

More than 160 years

offering financial advice

14.8%

CET1 capital ratio

UBS is one of the world’s best-capitalized banks

UBS Company Reporting as of 10/29/2025

Working with diverse clients with specific needs, our team sees it as our top responsibility to understand each aspect of your unique and often complicated financial life.

We help empower employees at all ages and income levels to build healthy financial habits and improve their relationship with their money, so they can take more control of their financial future. Our dedicated team of financial professionals provide guidance to help employees through the complexities of their finances, so everyone feels more engaged, productive and rewarded at work.

Our process takes you from the initial stages of exit or succession planning all the way through the transaction close. We develop a personalized strategy to help manage the proceeds and achieve your future financial goals—and life goals after you step away.

You've worked hard and carefully invested to ensure that you’ll live life on your terms in retirement. But are you ready for a retirement that could span 30 years or more? What’s the right plan to help make sure your retirement funds last? Our team will work with you to help preserve your lifestyle and livelihood in retirement by understanding your goals, risk and time horizon.

For more than 160 years, UBS has proven its strength and guided clients through a wide range of market opportunities and financial challenges. Time and again, we’ve been tested and proven resilient, and our clients continue to put their trust in us and our wealth management expertise to help them achieve their goals. Today, UBS is stronger than ever.

Creating a truly rewarding workplace

Your company’s success depends on attracting and retaining key talent. Everyone can flourish in a workplace where employees feel rewarded and want to stay. Together, we can help you create a truly rewarding workplace across a range of solutions.

This website uses cookies to make sure you get the best experience on our website. You can find more information under the Privacy Statement. You are free to change your cookies' settings in the privacy settings.

Go to privacy settings