2

Advisors on the team

Our mission at The Keyser Bobrowich Group is to provide personalized private wealth management services customized to your needs. For over two decades, our experienced team has been dedicated to servicing business owners, corporate executives, entrepreneurs, and affluent clients of all backgrounds with advanced wealth planning. You benefit from our knowledge and experience to help simplify your financial life by offering comprehensive advisory services.

We help you take control of your financial future with clarity and confidence. Whether you're growing a business, managing sudden wealth, or planning for retirement, we offer thoughtful guidance every step of the way. Our team provides customized investment strategies, comprehensive financial planning, and multigenerational wealth management—all designed to align with your values, goals, and lifestyle.

Our consultative approach helps to build strong relationships with clients by providing advice beyond investing. Financial advice is more important today than ever. The strong relationship helps our understanding of your unique needs at every stage of your financial life or career. Our wealth management focus is on you and your success.

Clients seek our experience when making important decisions so they can spend more time doing what they love with the people they care most about.

2

Advisors on the team

Business exits, ranging from

$15m - $1bn

Our mission is to provide quality strategies customized to your needs. Our goal is to be your primary source of financial advice. To this end, we concentrate our efforts on developing long-term relationships through a commitment to quality client service.

Our experience and structured planning process drives a comprehensive financial plan and customized investment strategies. Depending on where you are in your life and the priorities that matter most, our planning conversations may focus on liquidity management, your cash flow needs, asset replacement solutions such as insurance, estate planning strategies, or tax and legal structures such as trusts and philanthropic vehicles.

As a successful executive, you understand the importance of careful and robust planning and the right personal wealth management advice.

We provide advice to help families flourish for generations, through intentional communication, intergenerational wealth transitions, family governance, philanthropic legacies and more. Holistic insights, advice and execution services help you maximize your impact and build your legacy.

Our process takes you from the initial stages of exit or succession planning all the way through the transaction close. We develop a personalized strategy to help manage the proceeds and achieve your future financial goals—and life goals after you step away.

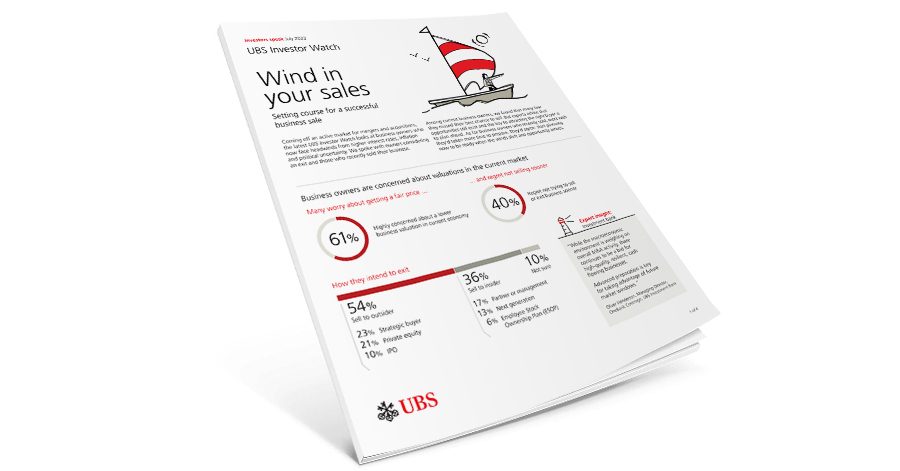

What business owners need to know now to prepare for a successful sale

73% of business owners who recently sold their companies spent two years or less preparing to sell. Yet 81% said they wish they’d spent more time preparing. Gain insights from business owners who recently sold in our latest Investor Watch report, Wind in your sales.

#1

for High Net-Worth clients

Euromoney Private Banking and Wealth Management Survey (peer review), 2015-2022

Financial strength

Driving confidence.

A- Standard & Poor’s

A Fitch

A3 Moody’s

UBS AG, long-term senior secured debt rating. As of 03/31/2024

51 countries

Our global footprint