Over $2BN

Assets under management

Heritage Wealth Management is committed to a multigenerational approach to wealth management. Our team spans five generations and has navigated the experiences that your family faces. We want to be your Family Office.

We provide a tailored approach that helps bring clarity, direction, and confidence. We support you over time with responsive emotional support, education and access to the wide array of services and connections that we provide.

With a bi-coastal effort from two offices—Portland, Oregon and Charleston, South Carolina—we are committed to your long-term success and strive every day to ensure your wealth stays aligned with your values and goals.

Always mindful of the challenges facing each generation, we chose the name ‘Heritage’ because we understand the importance of understanding your values and aspirations when planning your financial future.

Over $2BN

Assets under management

14

Years in business as a team

160

Collective years of experience

Our mission is to provide quality strategies customized to your needs. Our goal is to be your primary source of financial advice. To this end, we concentrate our efforts on developing long-term relationships through a commitment to quality client service.

CA Insurance license #4060921

Cameron started at UBS in one of the stock market's most tumultuous months on record. Over the past 20 years, he has helped clients manage their wealth through good times and bad. He joined UBS in August of 2001 and after three years of working on the equity research desk in New York City, he moved back to the Portland area to work with his father, Joe Cheek.

With his clients, Cameron emphasizes asset allocation and total wealth management with a focus on retirement planning. He also helps his clients with education funding, insurance planning, structures for charitable giving, and estate planning. FINRA-registered, Cameron holds the Series 7 and 66 licenses as well as licenses for life and health insurance.

Cameron earned his B.S. degree in finance from Linfield College. Cameron, his wife Becky, and daughters, Adelyn and Beatrice, live in Charleston, South Carolina. He enjoys golfing, traveling, and spending time on the beach with family and friends.

Joe began his financial career with U.S. Bank's Trust Department, where he probated estates and managed family and institutional trusts. He served as the Treasurer for Winter Products, which at the time, was the second largest furniture hardware manufacturer in the U.S. In 1980, he joined UBS predecessor firm Paine Webber.

As a Financial Advisor, Joe has always employed a broad range of strategies to help clients achieve their financial goals. His deep understanding of fixed income markets is a crucial aspect of the individualized plans he develops. Joe has served as a FINRA (formerly NASD) arbitrator since 1996 and is an industry expert in dispute resolution.

Joe earned his B.S. degree in business administration from Portland State University. He holds Series 7 and 63 securities licenses.

He enjoys a busy family life, spending time with his wife, Terra, traveling and squeezing in a round of golf during his spare time.

Wendy began her career in 1988 with PaineWebber and in 1995 had the great fortune to start working with Joe Cheek. Currently, with 20+ years working with Cameron Cheek and the Heritage team, she dedicates herself to providing superior service to our clients by anticipating their needs and managing day-to-day operations for the team. Wendy is FINRA-registered and holds Series 7 and 66 securities licenses.

Wendy earned her B.A. degree in business marketing from Portland State University. In her spare time, Wendy enjoys spending time with her niece and nephews.

Amanda was born and raised in Myrtle Beach, SC and graduated from the University of South Carolina Darla Moore School of Business in 2014 with a degree in International Business and Accounting. Amanda joined UBS in 2022 after 8 years working at Merrill Lynch. She serves as Wendy’s administrative right-hand, and she is here to answer any questions related to online services, paperwork, your monthly statement, estate planning, etc.

Amanda fosters dogs from local animal rescues, volunteers as an advisor for the Chi Omega Fraternity at the College of Charleston, and she serves as a board member of the Girls Scouts of Eastern South Carolina. Amanda loves to watch sports, spend the day on the boat or at the beach, and read a good historical fiction novel. She lives in Charleston, SC with her husband Brandon and their dogs Ruby and Beamer.

In January 2019, Stephanie began her working career with UBS as an intern for a team in Greenville, South Carolina. Shortly after receiving her degree in Business Administration with a Finance Principle from Bob Jones University in May 2019, she joined the team as a full-time team member. During her time in Greenville as a Client Associate, she gained experience working with high-net-worth clients, and received the SIE, Series 7, Series 63, and Series 65 securities licenses. After six wonderful years with the Greenville team, Stephanie moved to Mount Pleasant, SC to join Heritage Wealth Management. Outside of work, Stephanie enjoys exploring her new home city, attending and serving at Grace City Church, playing pickleball, and spending time with her family and friends.

CA Insurance license #4060921

Cameron started at UBS in one of the stock market's most tumultuous months on record. Over the past 20 years, he has helped clients manage their wealth through good times and bad. He joined UBS in August of 2001 and after three years of working on the equity research desk in New York City, he moved back to the Portland area to work with his father, Joe Cheek.

With his clients, Cameron emphasizes asset allocation and total wealth management with a focus on retirement planning. He also helps his clients with education funding, insurance planning, structures for charitable giving, and estate planning. FINRA-registered, Cameron holds the Series 7 and 66 licenses as well as licenses for life and health insurance.

Cameron earned his B.S. degree in finance from Linfield College. Cameron, his wife Becky, and daughters, Adelyn and Beatrice, live in Charleston, South Carolina. He enjoys golfing, traveling, and spending time on the beach with family and friends.

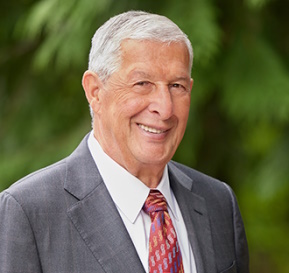

Joe began his financial career with U.S. Bank's Trust Department, where he probated estates and managed family and institutional trusts. He served as the Treasurer for Winter Products, which at the time, was the second largest furniture hardware manufacturer in the U.S. In 1980, he joined UBS predecessor firm Paine Webber.

As a Financial Advisor, Joe has always employed a broad range of strategies to help clients achieve their financial goals. His deep understanding of fixed income markets is a crucial aspect of the individualized plans he develops. Joe has served as a FINRA (formerly NASD) arbitrator since 1996 and is an industry expert in dispute resolution.

Joe earned his B.S. degree in business administration from Portland State University. He holds Series 7 and 63 securities licenses.

He enjoys a busy family life, spending time with his wife, Terra, traveling and squeezing in a round of golf during his spare time.

Wendy began her career in 1988 with PaineWebber and in 1995 had the great fortune to start working with Joe Cheek. Currently, with 20+ years working with Cameron Cheek and the Heritage team, she dedicates herself to providing superior service to our clients by anticipating their needs and managing day-to-day operations for the team. Wendy is FINRA-registered and holds Series 7 and 66 securities licenses.

Wendy earned her B.A. degree in business marketing from Portland State University. In her spare time, Wendy enjoys spending time with her niece and nephews.

Amanda was born and raised in Myrtle Beach, SC and graduated from the University of South Carolina Darla Moore School of Business in 2014 with a degree in International Business and Accounting. Amanda joined UBS in 2022 after 8 years working at Merrill Lynch. She serves as Wendy’s administrative right-hand, and she is here to answer any questions related to online services, paperwork, your monthly statement, estate planning, etc.

Amanda fosters dogs from local animal rescues, volunteers as an advisor for the Chi Omega Fraternity at the College of Charleston, and she serves as a board member of the Girls Scouts of Eastern South Carolina. Amanda loves to watch sports, spend the day on the boat or at the beach, and read a good historical fiction novel. She lives in Charleston, SC with her husband Brandon and their dogs Ruby and Beamer.

In January 2019, Stephanie began her working career with UBS as an intern for a team in Greenville, South Carolina. Shortly after receiving her degree in Business Administration with a Finance Principle from Bob Jones University in May 2019, she joined the team as a full-time team member. During her time in Greenville as a Client Associate, she gained experience working with high-net-worth clients, and received the SIE, Series 7, Series 63, and Series 65 securities licenses. After six wonderful years with the Greenville team, Stephanie moved to Mount Pleasant, SC to join Heritage Wealth Management. Outside of work, Stephanie enjoys exploring her new home city, attending and serving at Grace City Church, playing pickleball, and spending time with her family and friends.

Eligibility is based on quantitative factors and is not necessarily related to the quality of the investment advice. For more information on third party rating methodologies, please visit ubs.com/us/en/designation-disclosures.

Eligibility is based on quantitative factors and is not necessarily related to the quality of the investment advice. For more information on third party rating methodologies, please visit ubs.com/us/en/designation-disclosures.

How do you want to work together?

Thoughtful and accountable, we understand each client has a unique situation with diverse needs. That’s why we listen carefully, so we can work closely together and proactively uncover opportunities. With a full range of services, our aim is to be helpful in every aspect of your financial life.

What to expect from our team. We offer high-touch support that anticipates your needs and helps simplify your life. We bring together the boutique services of a dedicated team with the global resources of one of the world’s largest wealth management firms. In addition, our trusted and consistent client service team is always on-hand for a host of financial and administrative needs.

We’re in touch in the way that works best for you. Our entire team is highly accessible, offering consistent communication, personal touch points and ongoing reviews. Responsive and attentive, we provide a flexible communication plan specific to your schedule. Our investment reviews are an excellent planning tool and are available on request or at regular intervals (monthly, quarterly, semi-annually, or annually) depending upon your needs.

We can work closely with your other legal and tax advisors. We work together with your accountants, attorneys and trusted advisors, as well as our network of financial specialists within and outside UBS. That way, we can incorporate all perspectives into one integrated approach.

“It is gratifying to develop meaningful relationships with each of our clients. We build long standing relationships, that includes all generations within your family.”

— Wendy Pace

Neither UBS Financial Services Inc. nor any of its employees provide tax or legal advice. You should consult with your personal tax or legal advisor regarding your personal circumstances.

What do you want to accomplish with your wealth?

Our financial planning approach seeks to understand your individual needs and make sure that your financial decisions reflect both short term desires and long term goals.

A financial plan covers more than your investments. When we build a comprehensive financial plan, we start by listening and learning about you. Our goals-based approach to planning can help you see the connections between all aspects of your financial world, including insurance and liability, banking, lending, trust and estate, and philanthropy.

We help make sure your entire family is protected and prepared for the future. We look at all the areas of your family’s life—everything from retirement planning to education funding, supporting aging parents and long term care planning. We are keenly attuned to protecting the financial independence of your entire family, structuring a deliberate and meaningful family legacy and directing capital to reflect your values.

Estate planning and the impact on your taxes is a key consideration. If maximizing what you pass on to your heirs is a primary consideration, we offer strategies that are appropriate to your unique situation. Your investing success and rates of return should always be considered on an after-tax basis. By working with your tax professionals, we can help take measures that may minimize the drag of taxes.

“We take the time to understand your entire financial life so we can make the planning recommendations that put you on the right track to reaching your goals.”

— Cameron L. Cheek

Neither UBS Financial Services Inc. nor any of its employees provide tax or legal advice. You should consult with your personal tax or legal advisor regarding your personal circumstances.

Are you getting the best guidance for today and tomorrow?

A key concern among our clients is, simply, will they be able to retire comfortably. With a specialty in retirement and lifetime income planning, our team can work with you to help protect your lifestyle and livelihood in retirement.

Helping to make sure you have saved enough to retire comfortably. Entering retirement, many people fear the possibility of outliving their savings. Our protective strategies can help ease concerns about how long you will need to draw your funds in retirement and preparing for unexpected expenses.

Easing your concerns about generating enough income in retirement. With a full suite of financial planning tools, we’ll help you evaluate your potential retirement cash flow, income sources and your investment choices more clearly. We’ll look at such influences as risk and investment time horizon, evaluate your current asset allocation and work with you to maximize your employer benefits, address retirement income gaps, and optimize social security benefits.

We help you face the rising costs of healthcare. We address the potential significance of rising healthcare costs and the importance of long-term care planning. We objectively analyze all of your current insurance policies such as life, long-term care, and disability insurance to determine whether they meet your current and future needs. Our solutions help to protect your assets so you can maintain your lifestyle.

“We provide the perspective and guidance to help make sure you’re prepared for a long, healthy and secure retirement.”

— Teresa D. Hart

What are the best strategies for reaching your goals?

Once we’ve helped you define your financial and retirement goals, our team provides quality investment strategies tailored to your needs. With direct access to the global resources of UBS, we offer timely perspectives, customized investment management and a fully-integrated suite of financial solutions.

Building portfolios to withstand market volatility. We understand how today’s uncertain economy is the cause of a lot of anxiety. We help demystify investments by being straight-forward and clear about how we’re handling your hard-earned money. As active portfolio managers or by working with select money managers, we build custom portfolios. Ongoing monitoring and review helps us track your investments and quickly adapt to changes in the markets or in your life.

Understanding what risk mean to you. Through our comprehensive due diligence and planning process, we gain a deep understanding of your financial picture so we help balance your tolerance for risk with your family’s goals, growth and income needs. This allows us to craft an asset allocation that supports your financial plan and seeks to limit risk and lower volatility.

Access to financial solutions within and beyond UBS. We look for the right solutions for you, whether that can be found at UBS or elsewhere. This open architecture, along with a disciplined planning process, ensures we develop customized strategies specific to your unique situation that are based on highly-focused research.

“Our investment strategies focus on helping you preserve and grow your wealth in a way that’s accessible, educational and highly personable.”

— Cameron L. Cheek

Geopolitics, trade and your portfolio

In times of heightened uncertainty, who you trust for financial guidance matters more than ever. For over160 years, UBS has helped clients through times of volatility with clarity and resiliency.

Get in touch with our team and we’ll help you turn today’s market uncertainty into informed confidence.

$6.9 trn

UBS Group invested assets

As of 10/29/2025

51 countries

Our global footprint

Global leader

UBS is a leading and truly global wealth manager

This website uses cookies to make sure you get the best experience on our website. You can find more information under the Privacy Statement. You are free to change your cookies' settings in the privacy settings.

Go to privacy settings