$6.9 trn

UBS Group invested assets

As of 10/29/2025

At Alignment Partners, we‘ve purposely built a diverse team across industry experience, backgrounds, credentials and passions. That diversity of knowledge and perspective provides our successful clients—leaders in finance, founders of great companies and exceptional women—with the power to make informed decisions for their families. And yet we are also of one mind— in fact, in complete alignment—when it comes to our commitment to you, to sit on the same side of the table and to put your interests first. Above all, we strive every day to provide uncompromising service paired with transparent, thoughtful and unbiased advice.

New ideas. Holistic approaches.

As a group of forward-thinkers, we understand the value of bringing discipline to your financial world and applying innovative approaches to solve the complex issues that often accompany substantial wealth. Most importantly, whatever your objectives or the challenges you face, you‘ll find our team to be completely energized with new ideas, holistic approaches and solutions that are creatively designed and strategically managed. Each recommendation we make is tailored exactly for you, your priorities and the goals that matter.

A world of access and opportunity

Thoughtful wealth structuring and investment management will always be fundamental to our practice, given the depth of our capital markets knowledge and experience. The current environment and the ambitions of our sophisticated clients require us to have that edge. But we are also a team of advisors within a global firm that truly focuses on serving the needs of the world's most exceptional families. To us, it's that level of access, intelligence and engagement that can help you pursue your broader financial goals.

Through the exclusive UBS Private Wealth Management division, our team has access to the full depth and breadth of UBS resources and expertise:

Our process takes you from the initial stages of exit or succession planning all the way through the transaction close. We develop a personalized strategy to help manage the proceeds and achieve your future financial goals—and life goals after you step away.

Financial decision-making is easier when you have the benefit of a trusted source of advice. Our team is here for you with planning-based solutions to help you confidently take charge of your financial world. It's about helping you feel empowered to make important decisions about today’s opportunities and challenges—and tomorrow's.

The complexity of your wealth demands a critical understanding of how best to incorporate tax-efficient solutions into your overall financial plan. Together with our Advanced Planning team of trust and estate specialists, we’ll provide insights for developing your comprehensive estate plan. We‘ll continue to assess it against your short- and long-term needs, current markets and an evolving tax landscape.

Partnering with resources across UBS, including UBS Family Office Solutions as well as our global investment bank, we integrate institutional-level business solutions for family offices. From family governance to business transition, we help bridge the generations to preserve wealth, seize opportunity and create continuity.

We work with UBS Family Advisory and Philanthropy Services to provide advice to help families flourish for generations, through intentional communication, intergenerational wealth transitions, family governance, philanthropic legacies and more. Holistic insights, advice and execution services help you maximize your impact and build your legacy.

The challenges women breadwinners face embracing their financial clout

Women are contributing more to their families’ incomes than ever before. Yet many remain less engaged than men in decision-making about the money they’ve earned. Why?

We believe financial participation, comprehensive planning and the support of financial professionals can help correct this imbalance. See how in our latest Own your worth report, “Tradition, trust and time: The challenges women breadwinners face embracing their financial clout.”

We’re committed to understanding what wealth means for you.

At UBS, excellence comes from nurturing the best of our heritage, mastering the details and delivering the expertise you need to turn your financial vision into a reality. The result? Financial advice that is finely crafted for what matters most to you.

Looking past peak uncertainty with insights in four key areas: macroeconomics, operational considerations, policy, geopolitics and politics, and markets and corporate transactions.

Insights from 300+ UBS family office clients on strategic asset allocation, attitudes to risk, professionalization and governance, costs and staffing, and succession planning.

What you need to know now

Our bi-weekly newsletter gives you insights into what’s top of mind for investors:

A road map to help facilitate the process

Often, the process of selling a business is unknown to the business owner. This may leave them vulnerable to making significant mistakes. This brochure may serve as a general road map for facilitating the sale of a closely held business.

Passionately committed to holistic advice, service and results

As one of the Private Wealth Advisors with Alignment Partners, Alli provides customized, holistic wealth management advice and execution to a select group of sophisticated individuals and families. As the “face of her team,” Alli simply connects with clients personally and professionally. She is truly a relationship-builder whose service to clients goes above and beyond.

“I am impassioned by the intimate and mutually beneficial relationships and history I’ve built with many of my clients and the ability we have to impact their lives, their children and their dreams.”

While each member of Alignment Partners has their own areas of experience and focus, Alli brings her personal passions and insight to the team through her commitment to empowering women, as well as through Social Impact Investing and Philanthropic Advisory. From optimizing investment portfolios to engaging in the UBS Optimus Foundation and other innovative technologies in philanthropy, Alli strives to maximize families’ philanthropic giving, impact and legacy. Her advice and solutions are fully informed and enhanced by the unique perspective, structure and global reach of UBS, the only truly global wealth management firm.

Experience

-Managing Director, J.P. Morgan Private Bank

-Structured Equity Sales (OTC derivatives, hedge funds), Lehman Brothers

Credentials

-Series 7, 65 and 66 securities licenses

-M.B.A., finance, and international business, NYU School of Business

-B.S., economics and Spanish, University of Michigan

Life

-Alli is a proud working mother of two boys.

-She enjoys family, as well as the Spanish language, culture and music.

-Alli is a truly consistent voice for women in business and life, girl empowerment and gender equality.

-Her philanthropic pursuits reflect all of the above including support for Girl Rising and Friends of Hudson River Park.

As a Senior Wealth Strategy Associate, Brandon is primarily responsible for the management of investment and business operations of the Alignment Partners. He helps Alli to build and deepen relationships by providing exceptional Private Wealth Management services and solutions. His top priority is to utilize our financial planning tools to deliver a white-glove experience.

Prior to joining the Alignment Partners, Brandon was a financial advisor with the UBS Wealth Advice Center. On a daily basis, he was dedicated to providing the highest quality investment and financial planning advice and guidance to clients.

Experience

-Financial Advisor, UBS Wealth Advice Center

Credentials

-Series 7 and 66 securities licenses

-CERTIFIED FINANCIAL PLANNER™

-NY Life/Accident & Health Insurance Agent

-B.B.A., Stephen M. Ross School of Business, University of Michigan

Life

-Brandon currently resides in New York City with his wife, Hayley.

-His philanthropic pursuits include supporting his synagogue and the Arms Wide Open Childhood Cancer Foundation.

-In his free time, he enjoys traveling, playing golf, and is an avid fan of the New York Yankees.

Erin supports clients across all aspects of their financial lives, with a focus on relationship management and private banking services. She also oversees account operations and maintenance, ensuring a seamless and efficient client experience. Erin is committed to delivering proactive, thoughtful service that brings clarity and confidence to managing complex personal financial matters.

Credentials:

- SIE and Series 7 securities licenses

Personal:

Erin graduated from Syracuse University, where she studied Information Technology and Management and played Division I lacrosse for a nationally ranked program. She remains deeply connected to her athletic and academic roots and enjoys bringing the same discipline and teamwork to her professional career. Outside of work, Erin values time with her family, loves spending days at the beach, and lives in New York City.

Executive Director

Senior Wealth Strategist

Executive Director

Family Office Design & Governance Strategist

Managing Director

UHNW Plus and GFIW Americas Relationship Manager

Introduction

Michael Maquet is a Relationship Manager within UBS Global Wealth Management, focused on delivering solutions for Ultra-High Net Worth (UHNW) Plus and Global Family & Institutional Wealth (GFIW) Americas clients. UHNW Plus and GFIW Americas helps Financial Advisors meet their client’s most sophisticated needs by delivering access to wealth and institutional capabilities across the firm. Michael is dually registered with UBS Financial Services Inc. and UBS Securities LLC, ensuring close collaboration across both Global Wealth Management and Investment Banking teams.

Professional History

Prior to joining UBS, Michael was CEO of WPS Advisors, a family office investment manager. Previously he was CEO of W.P. Stewart & Co, a publicly-traded asset management firm which was acquired by AllianceBernstein. This came after a number of leadership roles at investment management organizations including Prudential Financial, New York Life Investment Management and Drake Global Management, a large global macro hedge fund. Michael began his career in the fixed income capital markets divisions of JPMorgan and Merrill Lynch. His experience includes long-only and hedge fund strategies across fixed income, fundamental equity, quantitative equity and global macro. He has led both investment, as well as distribution teams.

Education, Licenses, and Certifications

Michael graduated from The University of Virginia with degrees in Economics and French Language & Literature. He is the Chairman of the Board of The College Foundation at The University of Virginia. He and his wife live in New Jersey and have four grown children. He holds Series 7, 24 & 66 licenses.

Executive Director

Head, Portfolio Advisory Group Midwest, New York and Northeast Division

Executive Director

Senior Strategist, East Division - Family Advisory and Philanthropy Services

Executive Director

Head, Tax Efficiency Planning Strategist

Passionately committed to holistic advice, service and results

As one of the Private Wealth Advisors with Alignment Partners, Alli provides customized, holistic wealth management advice and execution to a select group of sophisticated individuals and families. As the “face of her team,” Alli simply connects with clients personally and professionally. She is truly a relationship-builder whose service to clients goes above and beyond.

“I am impassioned by the intimate and mutually beneficial relationships and history I’ve built with many of my clients and the ability we have to impact their lives, their children and their dreams.”

While each member of Alignment Partners has their own areas of experience and focus, Alli brings her personal passions and insight to the team through her commitment to empowering women, as well as through Social Impact Investing and Philanthropic Advisory. From optimizing investment portfolios to engaging in the UBS Optimus Foundation and other innovative technologies in philanthropy, Alli strives to maximize families’ philanthropic giving, impact and legacy. Her advice and solutions are fully informed and enhanced by the unique perspective, structure and global reach of UBS, the only truly global wealth management firm.

Experience

-Managing Director, J.P. Morgan Private Bank

-Structured Equity Sales (OTC derivatives, hedge funds), Lehman Brothers

Credentials

-Series 7, 65 and 66 securities licenses

-M.B.A., finance, and international business, NYU School of Business

-B.S., economics and Spanish, University of Michigan

Life

-Alli is a proud working mother of two boys.

-She enjoys family, as well as the Spanish language, culture and music.

-Alli is a truly consistent voice for women in business and life, girl empowerment and gender equality.

-Her philanthropic pursuits reflect all of the above including support for Girl Rising and Friends of Hudson River Park.

As a Senior Wealth Strategy Associate, Brandon is primarily responsible for the management of investment and business operations of the Alignment Partners. He helps Alli to build and deepen relationships by providing exceptional Private Wealth Management services and solutions. His top priority is to utilize our financial planning tools to deliver a white-glove experience.

Prior to joining the Alignment Partners, Brandon was a financial advisor with the UBS Wealth Advice Center. On a daily basis, he was dedicated to providing the highest quality investment and financial planning advice and guidance to clients.

Experience

-Financial Advisor, UBS Wealth Advice Center

Credentials

-Series 7 and 66 securities licenses

-CERTIFIED FINANCIAL PLANNER™

-NY Life/Accident & Health Insurance Agent

-B.B.A., Stephen M. Ross School of Business, University of Michigan

Life

-Brandon currently resides in New York City with his wife, Hayley.

-His philanthropic pursuits include supporting his synagogue and the Arms Wide Open Childhood Cancer Foundation.

-In his free time, he enjoys traveling, playing golf, and is an avid fan of the New York Yankees.

Erin supports clients across all aspects of their financial lives, with a focus on relationship management and private banking services. She also oversees account operations and maintenance, ensuring a seamless and efficient client experience. Erin is committed to delivering proactive, thoughtful service that brings clarity and confidence to managing complex personal financial matters.

Credentials:

- SIE and Series 7 securities licenses

Personal:

Erin graduated from Syracuse University, where she studied Information Technology and Management and played Division I lacrosse for a nationally ranked program. She remains deeply connected to her athletic and academic roots and enjoys bringing the same discipline and teamwork to her professional career. Outside of work, Erin values time with her family, loves spending days at the beach, and lives in New York City.

Executive Director

Senior Wealth Strategist

Executive Director

Family Office Design & Governance Strategist

Managing Director

UHNW Plus and GFIW Americas Relationship Manager

Introduction

Michael Maquet is a Relationship Manager within UBS Global Wealth Management, focused on delivering solutions for Ultra-High Net Worth (UHNW) Plus and Global Family & Institutional Wealth (GFIW) Americas clients. UHNW Plus and GFIW Americas helps Financial Advisors meet their client’s most sophisticated needs by delivering access to wealth and institutional capabilities across the firm. Michael is dually registered with UBS Financial Services Inc. and UBS Securities LLC, ensuring close collaboration across both Global Wealth Management and Investment Banking teams.

Professional History

Prior to joining UBS, Michael was CEO of WPS Advisors, a family office investment manager. Previously he was CEO of W.P. Stewart & Co, a publicly-traded asset management firm which was acquired by AllianceBernstein. This came after a number of leadership roles at investment management organizations including Prudential Financial, New York Life Investment Management and Drake Global Management, a large global macro hedge fund. Michael began his career in the fixed income capital markets divisions of JPMorgan and Merrill Lynch. His experience includes long-only and hedge fund strategies across fixed income, fundamental equity, quantitative equity and global macro. He has led both investment, as well as distribution teams.

Education, Licenses, and Certifications

Michael graduated from The University of Virginia with degrees in Economics and French Language & Literature. He is the Chairman of the Board of The College Foundation at The University of Virginia. He and his wife live in New Jersey and have four grown children. He holds Series 7, 24 & 66 licenses.

Executive Director

Head, Portfolio Advisory Group Midwest, New York and Northeast Division

Executive Director

Senior Strategist, East Division - Family Advisory and Philanthropy Services

Executive Director

Head, Tax Efficiency Planning Strategist

Eligibility is based on quantitative factors and is not necessarily related to the quality of the investment advice. For more information on third party rating methodologies, please visit ubs.com/us/en/designation-disclosures.

Eligibility is based on quantitative factors and is not necessarily related to the quality of the investment advice. For more information on third party rating methodologies, please visit ubs.com/us/en/designation-disclosures.

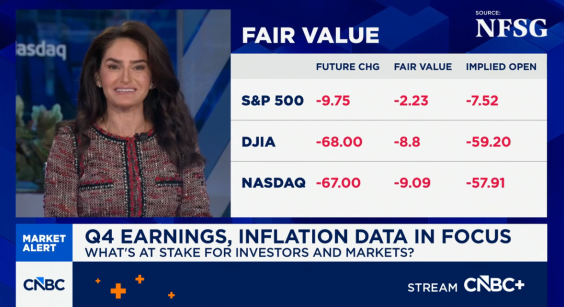

Alli McCartney, UBS Private Wealth Management managing director, joins ‘Squawk Box’ to discuss the latest market trends, state of the economy, market outlook, and more.

Watch here!

Alli McCartney, UBS Private Wealth Management managing director and UBS Alignment Partners founding partner, joins ‘Squawk Box’ to discuss the criminal probe facing Fed Chair Powell, impact on the markets, and more.

Watch here!

Alli McCartney, managing director at UBS Private Wealth Management, joins ‘Money Movers’ to discuss how the market has performed this year, what will keep it going, and more.

Watch here!

David Zervos, Jefferies chief market strategist, and Alli McCartney, UBS managing director, join 'Power Lunch' to discuss the historical context for today's equity markets, the Federal Reserve and much more.

Watch here!

Alli McCartney, UBS Alignment Partners managing director, joins ‘Money Movers’ to discuss markets, the payrolls growth revision and her Fed rate cut outlook.

Watch here!

Bad news doesn't sell off and good news, moves us forward. Hear the full commentary of what's moving the current markets, here in July and what to look out for.

Watch here!

Learn more about our team and the capabilities that we can provide for you.

$6.9 trn

UBS Group invested assets

As of 10/29/2025

51 countries

Our global footprint

Global leader

UBS is a leading and truly global wealth manager

This website uses cookies to make sure you get the best experience on our website. You can find more information under the Privacy Statement. You are free to change your cookies' settings in the privacy settings.

Go to privacy settings